Désolé. Actuellement, cette page n'existe pas en français.

Yann Ménière, EPO Chief Economist (left) and Aidan Kendrick, EPO Chief Business Analyst, discuss the key patenting trends at the EPO in 2020. The patent system has proven to be resilient, but the trends are diverse with increases in some technology sectors or from some countries balanced by sharp declines elsewhere.

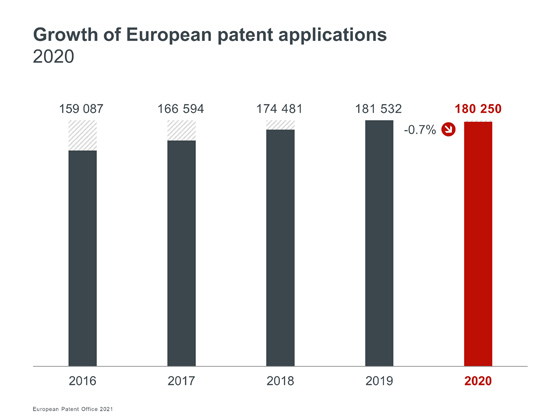

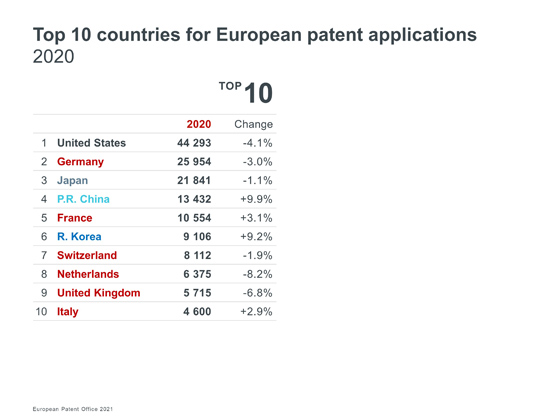

Despite the coronavirus pandemic, patent applications at the European Patent Office in 2020 remained stable overall, at 180 250 (down just -0.7% on 2019). This apparent status quo conceals two contrasting trends, with a fall in applications from companies based in the US, Europe and Japan, offset by continuing growth in applications from companies in South Korea and China.

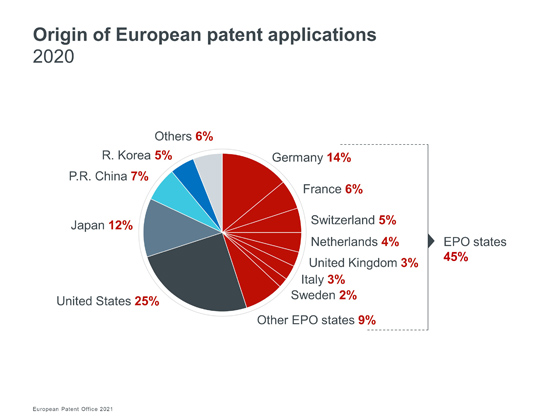

Overall the countries of origin for European patent applications remained roughly in line with recent years. Companies from Europe filed some 45% of all applications, with Germany, France and Switzerland in the lead. Applicants from the US contributed 25% of all filings, with 12% from Japan, 7% from China and 5% from South Korea.

In what has been a challenging year across all of Europe, any growth in patent applications would be remarkable, so companies from Finland, France and Italy stand out here. Companies based in most of the other leading European economies filed fewer European patent applications, with the most notable falls from Germany, Spain, the United Kingdom and the Netherlands.

The EPO itself has proven to be resilient in the face of the pandemic. Disruption has been kept to a minimum, and we were able to grant 133 715 patents last year, down 3.0% on 2019, but still the second highest ever.

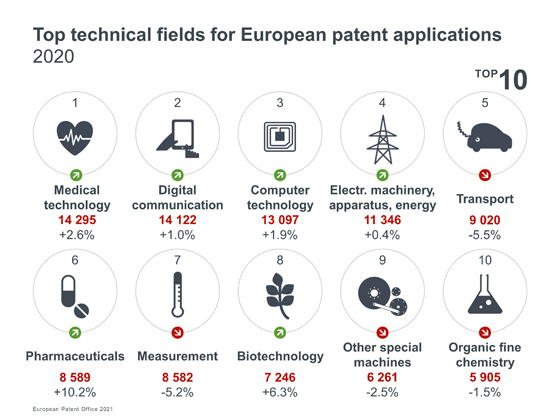

We know the pandemic has hit industry hard. The current crisis is showing asymmetric effects. Patenting activity in the healthcare sector remains strong, with the top field, medical technology, up 2.6%; and the two growth champions biotechnology and pharmaceuticals are up 6.3% and 10.2% respectively. This shows that investment remains strong in medical research for novel vaccines and therapeutics, as well as for diagnostic devices and medical equipment.

Conversely the impact on the aviation and automotive sectors is clear. The economic downturn is reflected by a fall of 5.5% in patent applications for transport related technologies, with most other areas of mechanical engineering falling even more.

Between these two extremes we saw several ICT fields posting modest growth for patent applications to the EPO in 2020. Digital communication was the second most active field overall, up 1.0%, with computer technology in third place, up 1.9%. Between them they comprised over 15% of all filings to the EPO last year. There was growth in most other fields related to electricity and energy, indicating the continuing importance of technologies for the Fourth Industrial Revolution as well as for renewable energy, transmission and storage.

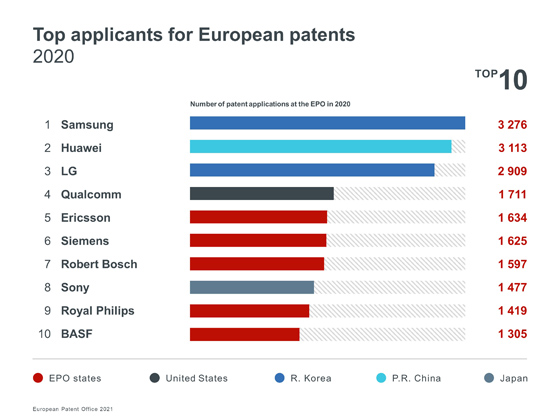

Amongst the largest applicants for European patents, five of the top ten companies are European, with Sony from Japan, Qualcomm from the US, Huawei from China as well as LG and Samsung from South Korea. Samsung moves back into the top spot again for the first time since 2014.